Dirayati Djaya is in the class of 2016, majoring in economics. She is an Empower fellow.

This summer, I have been lucky to be given the opportunity to work with Women's Microfinance Initiative (WMI), a microfinance organization based in Washington, D.C. that works with rural women in Kenya, Uganda, and Tanzania. Even in the midst of recent development in Africa, WMI responds to a specific need focusing on historically marginalized populations, women, in historically ignored areas, the rural villages and even some of which were displaced living in conservation areas. Africa’s middle class had “grown to 350 million people in 2010 from 126 million in 1980”, with development primarily spurred by international investment, a decrease in subsistence farming and turn to manufacturing and services, according to The New York Times.

African countries have started to turn to international investors to help their economies, which have created shopping malls and supermarkets, thus increasing consumption activity. This article states that the “entrepreneurial drive is present” and Africa will continue to push forward to strengthen its economy, but the best way to help these countries is to turn to international industries. The article also cites current problems with Africa’s current growth trends: rising economic inequality across classes, “the absolute number of impoverished Africans has gone up at the same time”, and across regions, the articles points to rise in businesses in urban centers like Dakar, Senegal and Kampar, Uganda as measures of success.

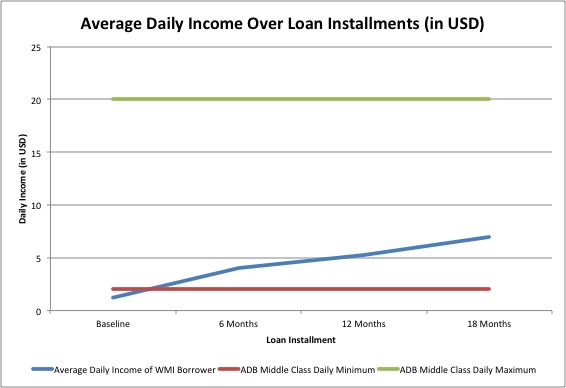

WMI believes that small businesses can fuel growth in the lower and middle class sectors with the help of small loans, instead of solely turning to international investors and large manufacturing plants. These women take loans and create their own business plans in their community. Most of these businesses use resources from the same community or an area nearby, which keeps the money flowing within their country and helping their own economy. The WMI system aims to localize economic activity, allowing rural women to reach the financial benchmark of “middle class”. According to the African Development Bank (ADB), the middle class in Africa makes between $2 and $20 USD daily.

Figure 1 shows that by the time WMI borrowers are ready for their second loan installment, they have on average reached this particular daily benchmark, and by the time they are ready for their fourth loan, they are making daily on average 200% more than the ADB middle class benchmark. By a statistical test, WMI has found that there is a statistically significant increase in the number of borrowers above the middle class benchmark from the beginning to the end of the program.

Due to the fact that many African countries have poor road infrastructure, development is primarily limited to the cities. WMI specifically works with rural villages to address the need to provincialize Africa’s economic growth. Thus these women do not have to wait for the growth from the cities but through loans and business training, are able to be active contributors to local growth, through local situated solutions, and Africa’s general growth as well. These new developments in Africa will not be able to solve these rural women’s issues. These small women-owned home grown businesses shifts the economic discussion proving how the rural villages can become places of high economic activity and how the women too can become economic agents.

Add new comment